Competitive analysis is a common practice to ensure your product is unique and competitive compared to others in the market. Once you have the breakdown of each product's differentiating features, you can perform an initial assessment on what price you could offer your product to the market using Economic Value to the Customer (EVC).

Competitive analysis is a common practice to ensure your product is unique and competitive compared to others in the market. Once you have the breakdown of each product's differentiating features, you can perform an initial assessment on what price you could offer your product to the market using Economic Value to the Customer (EVC).

Value-based pricing

There are many techniques to determine the price of a product in the market. We can categorize the pricing techniques into three main approaches. Value-based pricing is an approach that focus on the value customers put on your product's benefits. Others are cost-plus, which focuses on the cost of the product plus a set margin, and competitive pricing, which solely focuses on the competitive product's price and adjusts the target product's worth based on the price competition sets.

The advantage of value-based pricing is that it focuses the organization on determining what customers value the most. It also unravels opportunities and reduces risks compared to cost-plus pricing. With cost-plus pricing, you may miss the opportunity to charge a higher price when customers see the additional value or overcharge when they do not value the product as much, resulting in lower sales volumes.

Using Economic Value to Customer (EVC) as a technique for Value-Based Pricing

One of the techniques for conducting value-based pricing is the EVC. Initially designed mainly for B2B offerings, the EVC technique was first introduced by John L. Forbis and Nitin T. Mehta in their 1979 paper "Economic value to the customer." EVC focuses on discovering how much your customer would pay extra for the differentiation your product brings to the market compared to the closest alternative.

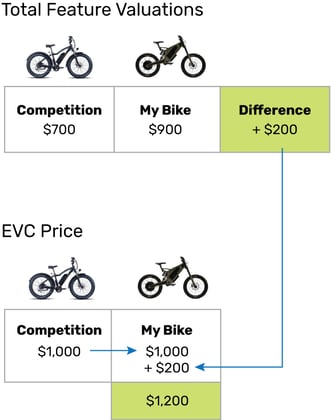

The calculation of EVC is the price of the best alternative + the value difference between your product and the alternative.

For example, let's assume you are producing an electric bike that is lighter in weight, and can go more miles in one charge than the next best alternative. If the alternative is priced at $1000 and you measure the value of a lighter bike and longer miles collectively at $200, then EVC for your product would be $1000+$200 or $1200.

Using EVC for product pricing

EVC will give you the maximum price a customer would pay or deem fair for your product. The price you set for your product would usually be less. To provide you with an example, let's assume you produce an electric car, which saves customers' gas cost. Let's assume the cost of charging the car is nominal. If customers, on average, pay $5000 over 5 year on gas. If you price your car equal to a fossil fuel alternative plus $5000, then the incentive to purchase an electric car may become a toss-up. But if you split the benefit, maybe 50/50, and offer your car with $2500 more, it will be more attractive for the customers in the market than the alternative.

The more you know about your customer and the value they associate with a benefit, the better you can determine the price to present your product in the market. To do so, you can conduct interviews with customers or see how they utilize your product. Measuring the difference between your product and the next best alternative is the first step in associating a value with it. If your product saves time, then measuring the amount of time is the first step, and the next is to understand how much value does that time have for the customer.

EVC is a great tool to itemize what makes your product different from the alternative and justify the price you demand from your customer. EVC can also act as a tool to check whether your current product price is optimal and justified in the market.

Mistakes to avoid when using the EVC technique

Many cases can result in calculating an EVC that does not represent reality. To increase confidence in the EVC calculation, you can do the following:

- Remove intangible benefits that cannot be measured objectively from the equation. Even though a product may have intangible benefits such as a product's style, if you can't clearly measure the benefits, it would be challenging to measure EVC objectively.

- Determine the competitor's price and benefits with care. The listed price is not always the selling price of the product. You may realize that the product is always selling at a discount, which would be its actual price.

- At times you need to factor in the switching costs if you intend to switch customers from other products to yours

EVC is an excellent method that can help understand the maximum price a customer is willing to pay for your products. It can validate current product prices or provide a guideline to set the price of your next upcoming product in the market. EVC needs to be calculated separately for each market segment. Each segment will value the product differently. EVC is not a one-time calculation. Since competitor products and prices change alongside market conditions, it is best to conduct EVC analysis periodically.